california mileage tax rate

However this has led to considerable debate about the economic benefits related to this new tax system. Have found Florida to be much.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Find Your Tax Rate.

. The 2019 IRS mileage rate is as follows. For questions about filing extensions tax relief and more call. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax.

However if an employers policy sets a higher per-mile reimbursement rate they may pay the higher amount. For 2022 the business mileage rate is 585 cents per mile. Labor Code Section 4600 in conjunction with Government Code Section.

Motor Vehicle Fuel Tax Law RT Code Section 7392 Rate of Tax The tax is imposed upon every aircraft jet fuel dealer at the rate of 002 for each gallon the aircraft jet fuel sold to an aircraft jet fuel user or used by the dealer as an aircraft. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg. 2022 Personal Vehicle Mileage Reimbursement Rates 2019 Personal Vehicle Mileage Reimbursement Rates.

Mileage reimbursement based on IRS mileage rate is presumed to reimburse employee for all actual expenses. The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 585 cents per mile in 2022 up 25 cents from 2021 the IRS. The California Road Charge Pilot Program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage.

What is the irs mileage rate. 2022 personal vehicle mileage reimbursement rates Service vehicles will charge based on mileage from their office to your location. The standard automobile mileage reimbursement rate set by the IRS for 2018 - 545 cents per mile.

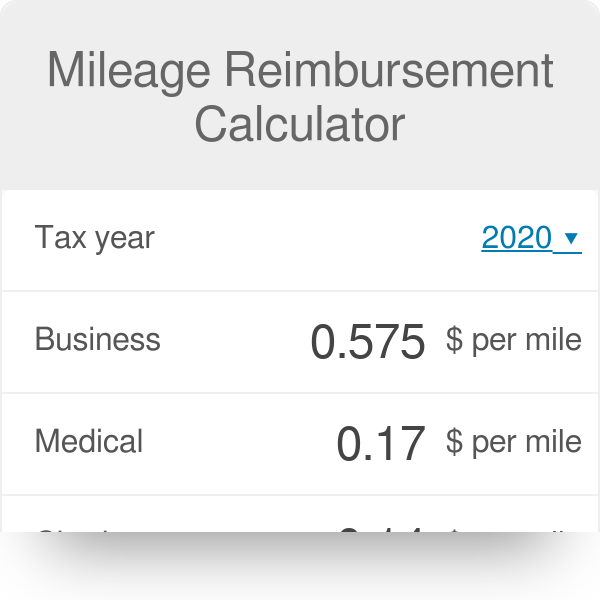

As of January 2021 the Internal Revenue Service slightly decreased the required reimbursement rate per mile from 0575 cents per mile to 056 cents per mile. Online videos and Live Webinars are available in lieu of in-person classes. I have been resisting against all common sense leaving California completely.

I dont want to sell my home but it is time. The IRS publishes standard mileage rates each year and sometimes adjusts these rates during the year. The standard automobile mileage reimbursement rate set.

Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively that yielded mixed results. Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile. Instead of paying at the pump when purchasing fuel a mileage tax system determines a drivers vehicle. Irs Mileage Rate 2022 California.

Rick Pedroncelli The Associated Press. Register for a Permit License or Account. The standard automobile mileage reimbursement rate set by the IRS for 2017 - 535 cents per mile.

California workers comp medical mileage rate will increase to 585 cents per mile in 2022 Mileage reimbursement rate 2022 irs. 585 cents per mile was 56 cents in 2021 medical moving. Stay tuned for the newest 2021 gsa per diem.

This rate must be paid for travel on or after January 1 2022 regardless of the date of injury. The Division of Workers Compensation DWC is announcing the increase of the mileage rate for medical and medical-legal travel expenses by 25 cents to 585 cents per mile effective January 1 2022. In California Jet Fuel is subject to a state excise tax of 002 per gallon.

Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 126 per statute mile. Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

15 rows The following table summarizes the optional standard mileage rates for employees. The futa tax rate is06 all year. The standard mileage rates for 2021 are as follows.

The motor vehicle fuel tax is imposed upon each gallon of fuel entered or removed from a refinery or terminal rack in this state. Today this mileage tax. The standard automobile mileage reimbursement rate set by the IRS for 2019 - 58 cents per mile.

Identify a Letter or Notice. Interest is computed on overdue taxes in each jurisdiction at a rate of 4167 per month. Please contact the local office nearest you.

California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. The Standard Auto Mileage Rate For Reimbursement Of Deductible Costs Of Operating An Auto For Business Will Be 585 Cents Per Mile. What is the mileage rate for 2020 in California.

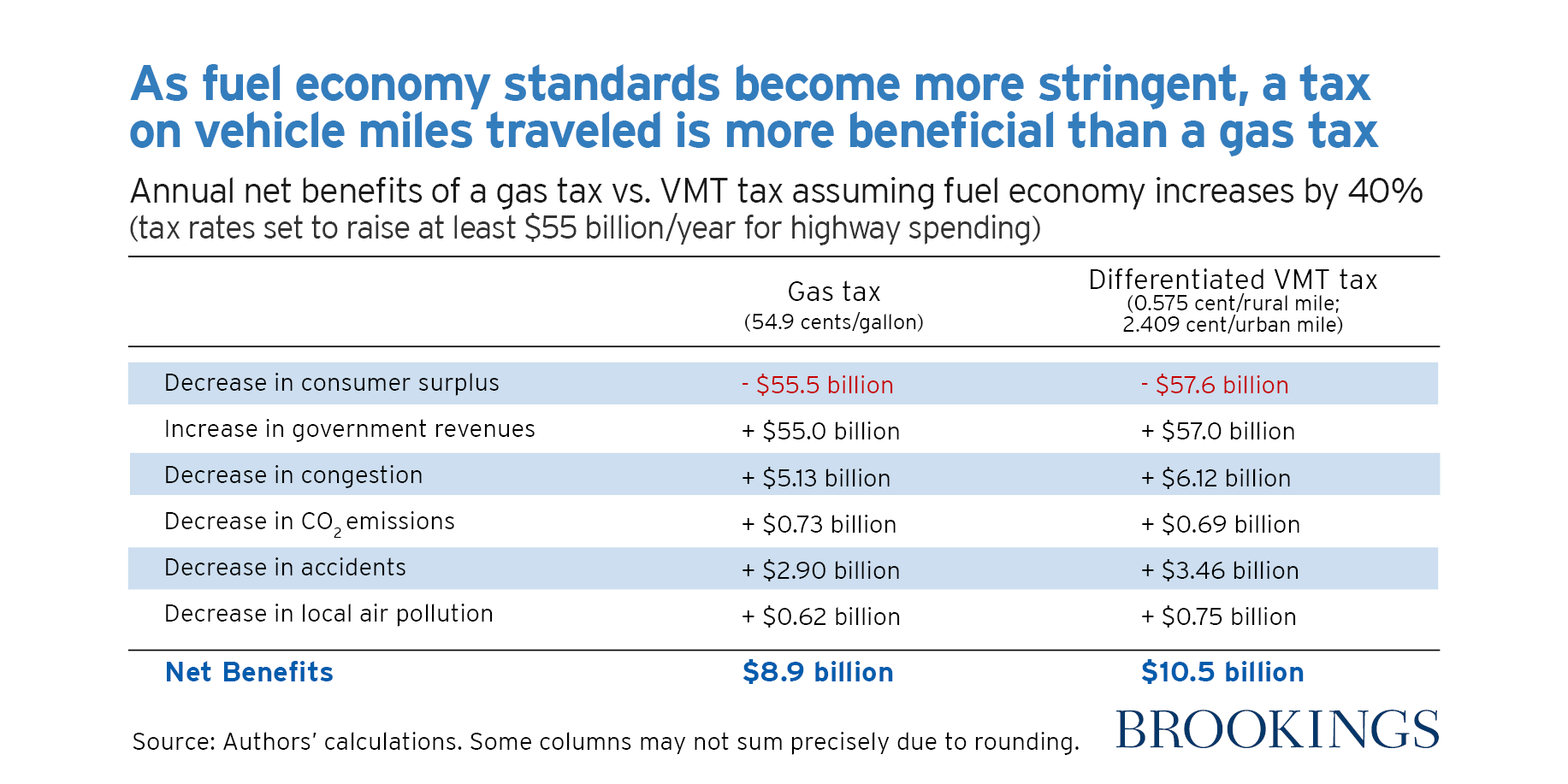

This rate must be paid for travel on. In this article we will study more about the shortcomings of the gas tax and understand why mileage tax is touted to be the better alternative. 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for 2021 and.

Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. As of June 18 2021 the internet website of the California Department of Tax and Fee. Businesses impacted by the pandemic please visit our COVID-19 page.

California is one of the first states to show interest in adopting the mileage tax system. 58 cents per mile for business miles driven up 35 cents from 2018.

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Cpa Practice Advisor

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

Mileage Reimbursement Calculator

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

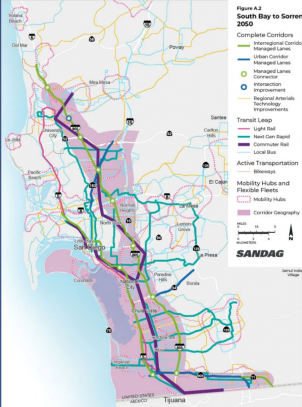

Sandag Approves Mileage Tax Over Objections Of Unfairness To East County East County Magazine

What Are The Mileage Deduction Rules H R Block

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How The Irs Mileage Rate Violates Ca Labor Code 2802 A

What Is The Irs Mileage Rate For 2022

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Irs Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher Gas Prices

New 2022 Irs Standard Mileage Rates

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

2021 Mileage Reimbursement Calculator

Irs Raises Standard Mileage Rate For 2022

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data